Receivable Collection Period Formula

An AP department also takes care of internal payments for business expenses travel and petty cash. Compare accounts receivable collection period to the standard number of days customers are allowed before a payment is due.

Average Collection Period Definition And Formula Bookstime

We start by replacing the companys first period of receivables with the January 1 data and last period with the information for December 31.

. And at the beginning of the year receivable 5000 and at the end of financial year receivable was 6000 credit sales are 120000. Let us consider the following Days Sales Outstanding example to understand the concept better. In other words this indicator measures the efficiency of the firms collaboration with clients and it shows how long on average the companys clients pay.

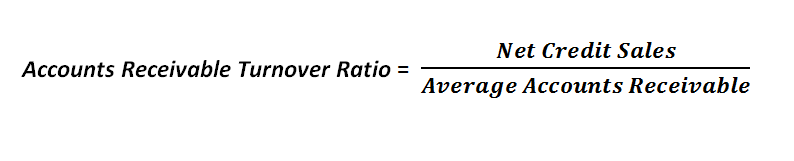

Net sales is calculated as sales on credit - sales returns - sales allowances. The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. The formula for calculating the AR turnover rate for a one-year period looks like this.

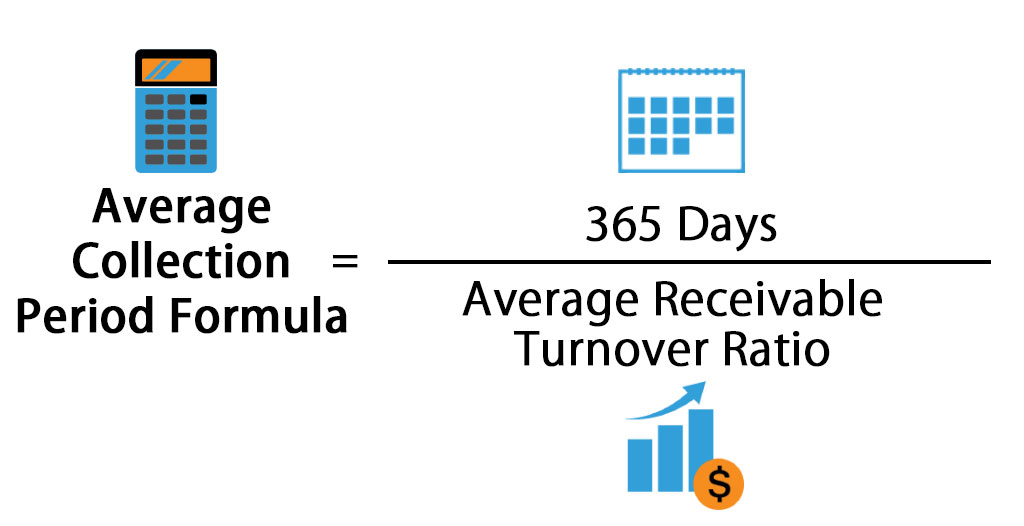

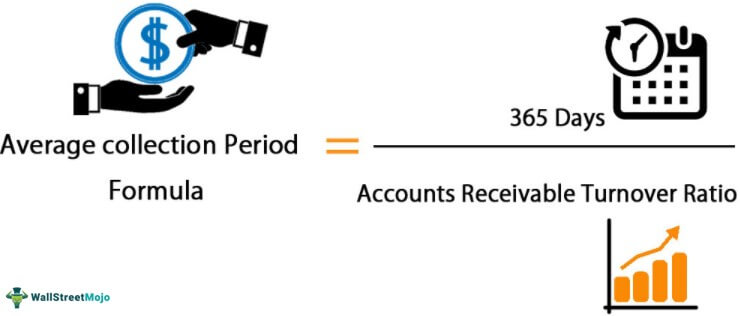

In the first formula to calculate Average collection period we need the Average Receivable Turnover and we can assume the Days in a year as 365. PG HA Average receivables collection day 365 Receivable turnover Effectiveness of firms credit policies and level of investment in receivables needed to maintain firms sales level. Lets talk about how a company calculates its average collection period.

Payment such as cash or a check that you receive from your customers for goods or services. Receivable turnover Net sales Average net trade receivables Liquidity of receivables Benchmark. Here are some examples in which an average collection period can affect a business in a positive or negative way.

You can enter two types of receipts in Receivables. A company reported RS 2000 as beginning inventory and 5000 as inventory for the financial year ended 2017 with the cost of goods sold 50000. The formula to.

Whether a collection period of 6083 days is good or bad for Maria depends on the payment terms it. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short-term investmentsThe current liabilities section typically includes accounts payable accrued expenses and taxes customer deposits and other trade debt. Average number of days until AR collected.

The calculation of days sales outstanding DSO involves dividing the accounts receivable balance by the revenue for the period which is then multiplied by 365 days. Revenue earned from investments interest refunds stock. Average accounts receivable First period Last period 2 Lets plug Alpha Lumbers data into the formula.

Accounts Payable is on a companys balance sheet as a current liability and is a collection of short-term credits extended by vendors and creditors for good and services received by a business. Formula for Average Collection Period. Generally the average collection period is calculated in days.

It is also known as Days Sales Outstanding. On the face of it this seems beneficial to the. The formula applied here is IFTable2This RowDays Past Due Date IFTable2This RowDays Past Due Date.

Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable. Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time generally monthly quarterly or annually divided by two. Days sales outstanding DSO is a measure of the average number of days that it takes a company to collect payment after a sale has been made.

The formula looks like the one below. That means the company has paid its average accounts payable balance 625 times during that time period. The Days Sales Outstanding formula to calculate the average number of days companies take to collect their outstanding payments is.

Accounts Receivable Turnover Days Accounts Receivable Turnover Days Average Collection Period an activity ratio measuring how many days per year averagely needed by a company to collect its receivables. Against the simplicity of the formula the calculation and practical usability of this formula have. Days Sales Outstanding - DSO.

Some people also choice to include the current portion of long-term debt in the liabilities section. Delays in accounts receivable collections can lead to lower cash flows. Average Collection Period Formula Average accounts receivable balance Average credit sales per day The first formula is mostly used for the calculation by investors and other professionals.

Use the Receipts window to enter new or query existing receipts. Here till the date Max Enterprises pays Ace Traders the amount of 100000 will be called as accounts payables and shown as liability towards creditors in the balance sheet. Say that in a one-year time period your company has made 25 million in purchases and finishes the year with an open accounts payable balance of 4 million.

High DSO Inefficient Cash Collection from Credit Sales Less Free Cash Flow Days Sales Outstanding DSO Formula. This means its accounts receivable is turning over approximately 9 times per year. The accounts receivable turnover ratio formula looks like this.

Max Enterprises purchased goods worth 100000 from Ace Traders. Ace Traders offered a credit period of 30 days within which the bill should be paid by Max Enterprises. Average Collection Period 365 Days or 12 Months Debtor Receivable Turnover Ratio For calculation of the receivable turnover ratio you can use our.

For example suppose a company has an accounts receivable collection period of 40 days. The formula for the average payment period. Marias average collection period as computed above is 6083 days which means the company on average takes 6083 days to collect a receivable.

Calculate the AR turnover in days. The company must calculate its average balance of accounts receivable for the year and divide it by total net sales for the year. 25 million 4 million 625.

DSO Accounts ReceivablesNet Credit SalesRevenue 365. More Resources on Small Business Accounting. The collection of Accounts Receivable defines the cash flow of a company.

The given formula can be used to calculate the average payment period APP average accounts payable total credits period. Days Sales Outstanding Formula. This metric overlooks non.

Also known as cash receipts. DSO is often determined. Average Collection Period Formula.

Cash Conversion Cycle Formula Example 1. Average Collection Period. Increasing Accounts Payable Turnover Ratio.

For instance other matrices like inventory days and receivable collection need to be calculated to assess the businesss cash position.

Average Collection Period Formula And Calculator Excel Template

Average Collection Period Formula Calculator Excel Template

Average Collection Period Meaning Formula How To Calculate

Average Collection Period Meaning Formula How To Calculate

0 Response to "Receivable Collection Period Formula"

Post a Comment